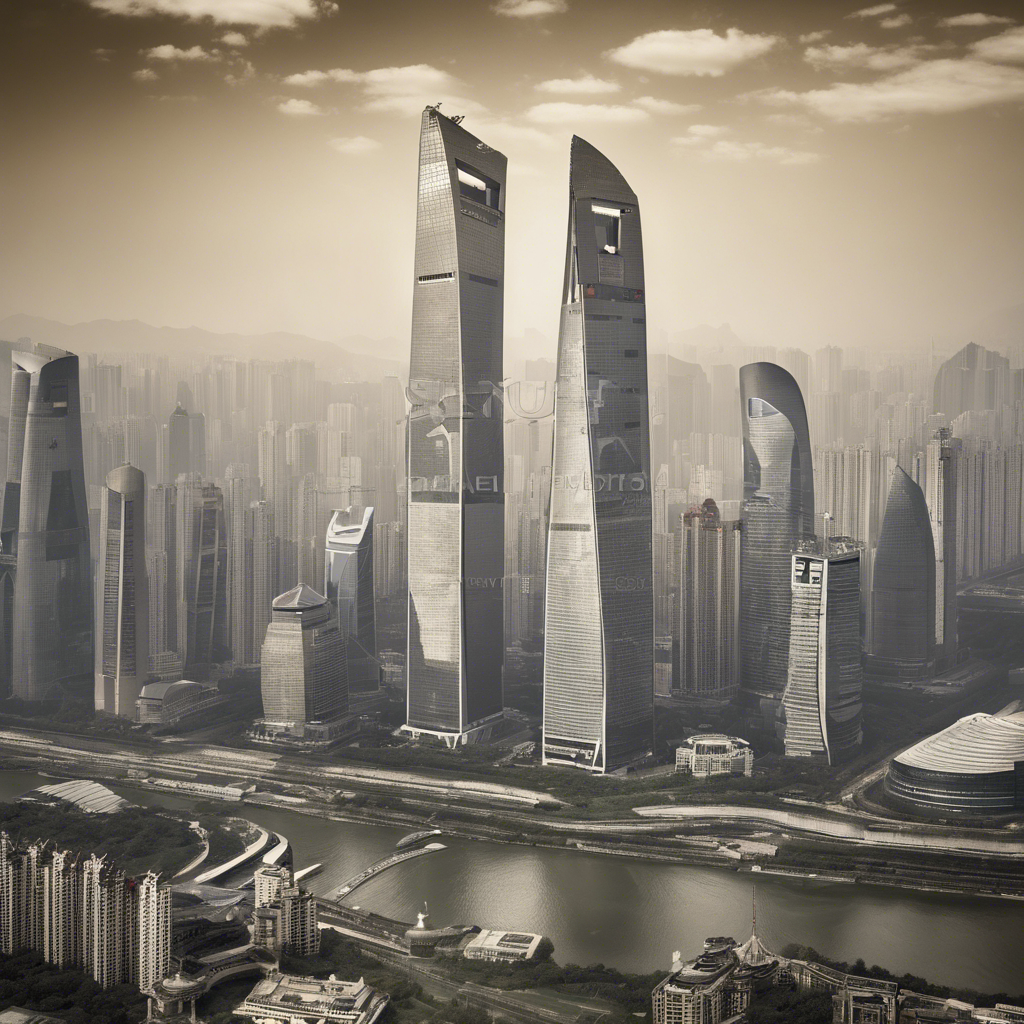

China’s Capital Flight: Seeking Safe Havens Abroad

Economic uncertainties and political concerns drive capital outflows from China, leading wealthy individuals and businesses to seek refuge in other countries.

The economic landscape in China has taken a downturn, leaving investors and businesses grappling with a lacklustre outlook for growth, corporate defaults, and capricious autocratic leadership. As a result, capital outflows from the country have reached unprecedented levels, with foreign investors and wealthy Chinese individuals seeking safer investment opportunities and jurisdictions. This article explores the reasons behind China’s capital flight, the strategies employed to bypass capital controls, and the emerging destinations for Chinese funds.

A Surge in Capital Outflows

China’s CSI 300 index has plummeted by 13% in 2023, prompting concerns among investors. The property market’s difficulties and corporate defaults have further exacerbated the financial climate. The combination of these factors, along with the need to navigate autocratic leadership and uncertain relations with trading partners, has led to a surge in capital outflows. Foreign investors and wealthy Chinese individuals are withdrawing their investments from China, resulting in a five-quarter streak of cross-border outflows from stocks and bonds.

Dodging Capital Controls

Escaping China’s capital controls has become a priority for investors looking to protect their assets. Some individuals resort to piecemeal transfers, such as purchasing tradable insurance policies in Hong Kong. Mainland residents can legally spend only $5,000 at a time, but sales of insurance to mainland visitors have surged in recent years. Additionally, misinvoicing trade shipments, by overstating the value of goods, has become a method for business owners to move money out of the country.

Changing Investment Destinations

The welcoming attitude towards Chinese capital seen in the past has waned in many countries. American state legislatures have passed bills blocking foreign citizens residing overseas from buying land and property. Canada has completely banned non-residents from purchasing real estate. Golden visa programs in Europe, which offer residency rights in exchange for investment, are being tightened or abolished. Hong Kong, once a popular gateway for Chinese capital, has lost its appeal following the political crackdown.

Singapore’s Growing Role

Singapore has emerged as an important destination for Chinese capital, thanks to its proximity, low taxes, and Mandarin-speaking population. Direct investment from Hong Kong and mainland China has risen by 59% since 2021. The number of family offices in Singapore has also increased, driven by Chinese demand. While the assets held through these vehicles lack transparency, Singapore’s banks have benefited from Chinese inflows, boosting profits for institutions like DBS and Overseas Chinese Banking Corporation.

The Rise of Neutral Locations

Neutral countries, such as Dubai and Japan, have also witnessed an influx of Chinese capital. Inquiries about Japanese properties from clients in China and Hong Kong have tripled in the past year, aided by a weak Japanese yen. Video calls and virtual property viewings have become the norm for Chinese buyers. Australia, too, has experienced a surge in overseas demand for property, primarily from potential owner-occupiers. Chinese buyers are now opting for spacious homes rather than smaller properties for investment purposes.

Conclusion:

China’s economic challenges and political uncertainties have led to a significant outflow of capital from the country. Investors and businesses are seeking safe havens abroad, bypassing capital controls and exploring alternative destinations. While countries like Singapore, Japan, and Australia have benefited from this capital flight, concerns about housing markets and potential illicit activities have arisen. As China’s capital flight continues, the impact on global markets and investment landscapes will persist, creating both opportunities and challenges for investors and host countries alike.