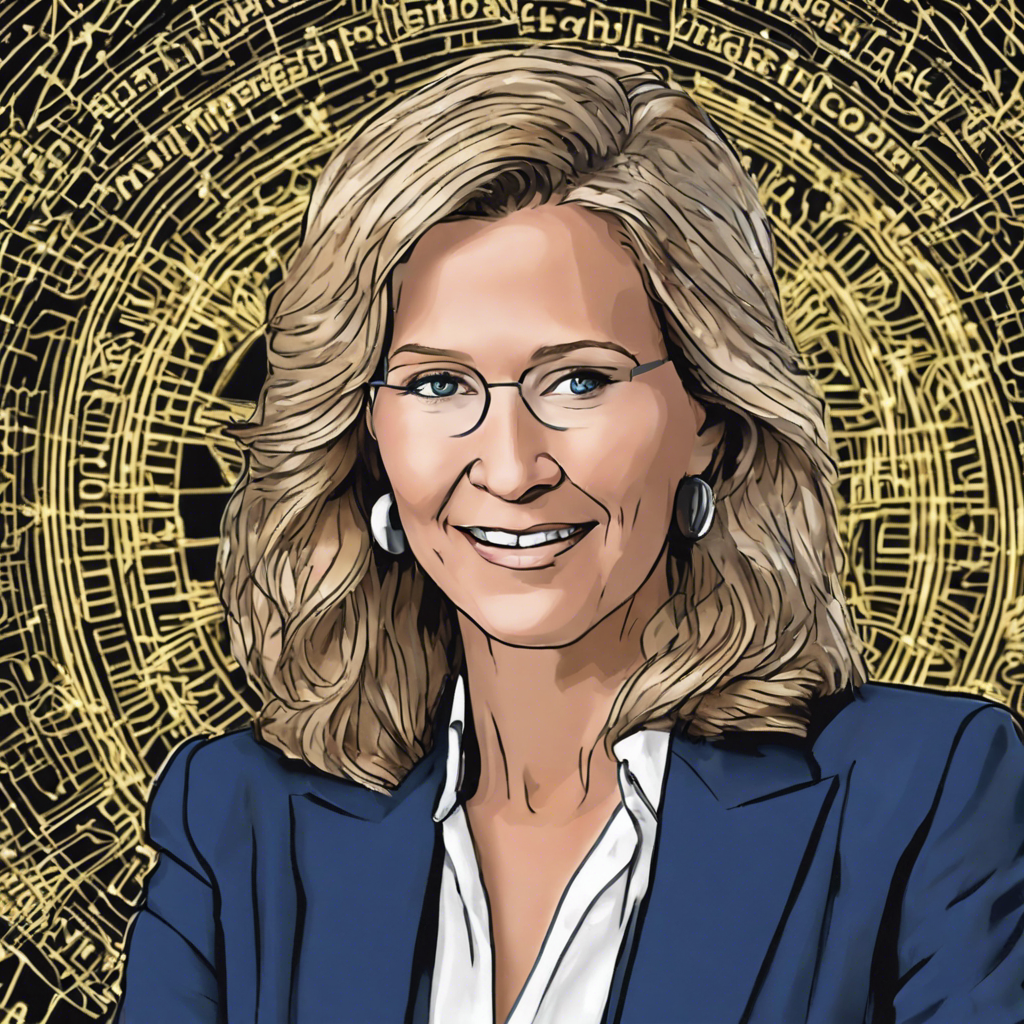

Franklin Templeton CEO Jenny Johnson on Blockchain’s Role in Democratizing Markets

In an exclusive interview, Jenny Johnson discusses Franklin Templeton’s exploration of blockchain technology and its potential to revolutionize the financial industry.

At the Fortune Global Forum in Abu Dhabi, Jenny Johnson, the president and CEO of Franklin Templeton, shared insights into the firm’s active exploration of blockchain technology. Having recently filed an application for a Bitcoin ETF, Franklin Templeton is at the forefront of embracing the potential of blockchain to transform the financial industry. In this interview, Johnson discusses how blockchain fits into the firm’s long-term strategy and its potential to democratize markets.

Blockchain: Unlocking the Future of Finance

Blockchain technology holds the promise of revolutionizing the financial industry by reducing transaction costs and enabling the securitization of traditionally hard-to-process assets. Johnson emphasizes that while Bitcoin has its own use case, it is the underlying blockchain technology that truly excites her. By eliminating friction in transactions, blockchain can unlock access to private markets and fractionalize ownership of assets that were previously operationally challenging to consider.

Efficiency and Transparency: The Benefits of Blockchain

Johnson highlights the potential for blockchain to make financial products more efficient. For example, by building a pooled vehicle on the blockchain, the underlying value of securities can be instantly determined through smart contracts, enhancing the transparency and accuracy of pricing. Additionally, the use of atomic settlement ensures immediate settlement, reducing the potential for fraud and eliminating latency in the system. Franklin Templeton has already developed a tokenized money-market fund and is actively involved in advising on portfolios, demonstrating its belief in the transformative power of blockchain.

The Path to Approval: Bitcoin ETFs

When questioned about the timeline for the approval of a Bitcoin spot ETF, Johnson acknowledges that it is ultimately in the hands of regulators. However, she expresses confidence that regulators will prioritize consumer protection and approve a spot ETF in due course. Johnson believes that a spot ETF will provide a more convenient and efficient way for investors to access Bitcoin, as long as bid-ask spreads remain narrow.

Client Interest and Responsible Investing

Johnson acknowledges the demand for Bitcoin among clients but highlights the challenges of anchoring it to a specific investment thesis. Bitcoin’s risk-on/risk-off nature requires responsible allocation by clients. While Franklin Templeton expects an influx of funds after the approval of a Bitcoin spot ETF, responsible investing remains a priority.

Blockchain’s Influence on Franklin Templeton’s Product Offering

Franklin Templeton is open to launching other blockchain- or crypto-related products in the future. However, Johnson notes that retirement plans, which are guided by fiduciaries, may not see significant adoption of ETFs. Nevertheless, Franklin Templeton is committed to making its products available in various investment vehicles, including those enabled by blockchain technology.

Tokenization and Future Opportunities

Johnson sees tokenization as a significant opportunity for investment as blockchain technology matures. Franklin Templeton’s expertise lies in making risk-adjusted investment decisions, and blockchain provides a new channel to deliver their expertise. The success of Franklin Templeton’s tokenized U.S. money-market fund, with over $270 million in inflows, further reinforces the firm’s belief in the potential of tokenization.

NFTs: A Mixed Bag of Opportunities

Regarding non-fungible tokens (NFTs), Johnson takes a pragmatic approach. While acknowledging the potential for success in the NFT space, she emphasizes the importance of making investments anchored in financial returns. Johnson believes there will be opportunities in the NFT market, particularly in areas like art, where there is a market price for items that resonate with buyers. However, she cautions that not all NFT investments will be successful.

Conclusion:

Franklin Templeton’s CEO, Jenny Johnson, is optimistic about the transformative power of blockchain technology in the financial industry. By reducing transaction costs, enhancing efficiency, and enabling access to previously inaccessible markets, blockchain has the potential to democratize finance. While awaiting approval for a Bitcoin spot ETF, Johnson emphasizes the need for responsible investing and acknowledges the opportunities presented by tokenization and NFTs. As Franklin Templeton continues to explore blockchain’s potential, it remains committed to delivering its expertise through innovative investment vehicles.